PPI issued the following press release today:

Power in the Public Interest Says Consumers “Deeply Disappointed” in Electricity Restructuring and Price Deregulation

FERC Urged to Compare Prices in RTO Regions with Traditional Cost-Based Systems

Olympia, WA—Emphasizing the Federal Energy Regulatory Commission’s obligation under the Federal Power Act to produce “just and reasonable” rates, Power in the Public Interest (PPI) urged FERC to compare consumer prices in Regional Transmission Organization (RTO) areas with prices in traditional cost-based systems and bilateral markets.

In its response to FERC’s Advance Notice of Proposed Rulemaking on Wholesale Competition in Regions with Organized Electric Markets, PPI said it supported the commission’s efforts to determine how RTO operations might be improved because consumers so far have been “deeply disappointed” in electricity restructuring and price deregulation.

“RTOs are corporations with no stockholders, no citizen voters, and no end-use ratepayers to hold them accountable for costs in the usual way that these groups exercise cost and profit pressures on traditional utilities, whether investor-owned, municipal or cooperative,” said PPI.

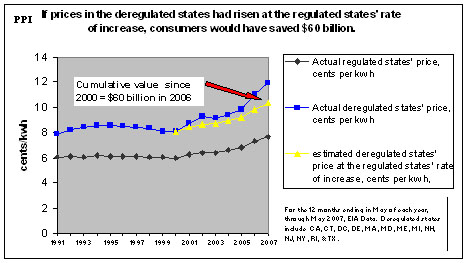

At issue is whether RTOs produce net consumer value over the long term, PPI said. Using Energy Department data, PPI noted in its comments that, on average, consumers in price-deregulated states pay 4 cents/kwh more for electricity today than do consumers in states with regulated prices, including price caps—up from a 2 cents/kwh differential in 2000.

“This is not to say that deregulation/restructuring is responsible for the whole gap, or that the gap can be closed. The gap does, however, reveal the significant economic disadvantage suffered by customers in the price-deregulated states, and the imperative for the Commission and the regions—whatever their resource mix—to ensure they are pursuing the most effective form of economic regulation of electricity,” PPI told FERC.

In addition, PPI said, the widening gap is “strongly consistent with the proposition—which should be more thoroughly considered—that RTO marginal pricing policies, market power, and open-access markets are driving up prices for ultimate consumers on a sustained basis. The Commission should pursue this question rigorously.” PPI noted that all states that have deregulated retail prices for a significant portion of their electricity customers are also participating in RTOs. Retail prices are thus a combination of the effects of wholesale and retail pricing policies.

For more on how this graph was constructed go to http://www.ppinet.org/graph_construction.php

Excerpts from Power in the Public Interest Sept 13 filing with FERC

“These comments focus on some of the fundamental elements at issue:

- The neither-fish-nor-foul nature of RTOs. The lines of public accountability in RTOs are inherently weak, placing an extra-heavy burden on the Commission to regulate them in the public interest.

- The Commission’s obligation under the Federal Power Act to ensure that RTOs produce just and reasonable rates. As part of this obligation, the Commission should engage in an on-going and rigorous review of prices in RTO regions, and their effect on end-use consumer prices—compared to more traditional cost-based systems and bilateral markets.

- The consequences of marginal pricing and single-clearing-price auctions. This central feature of RTO day-ahead markets guarantees that all plants needed in a given time period are paid the highest price bid by any participating plant. Many plant owners are paid amounts far above their incremental costs to supply power into these day-ahead (and hourly) markets. Not surprisingly, the owners of these plants find that supplying power through long-term, fixed-priced contracts is a comparatively less attractive business opportunity. Consumers, of course, pay the consequences. The best way to encourage long-term contracting, a goal with which PPI agrees, is to constrict or remove opportunities for unwarranted profits in the day-ahead market.”

“Some advocates claim we haven’t waited long enough for the inevitable cycling of marginal prices to below average price, at which time consumers in competitive markets will make up for what they lost, and consumers in cost-based systems will suffer. This crystal ball is unreliable, given the growing demand for resources worldwide and renewable energy requirements legislated by many states. On September 12, 2007, world oil prices topped $80 per barrel for the first time. Absent a collapse in the economy (that drops demand for electricity), the marginal bid—whether based on natural gas, renewable resources, or collective market behavior—is likely to stay above average system costs for some time come. Nor is it clear that lower organized wholesale prices, should they occur, would flow through to end-use consumers. Moreover, time is no friend to consumers and businesses paying high prices now. It is unfair to expect them to foot the bill for a promised benefit they may not survive to see, if it ever comes at all.”